The Main Principles Of Clark Wealth Partners

Table of ContentsClark Wealth Partners Can Be Fun For EveryoneThings about Clark Wealth PartnersNot known Incorrect Statements About Clark Wealth Partners See This Report on Clark Wealth PartnersClark Wealth Partners Can Be Fun For EveryoneThings about Clark Wealth PartnersThe Basic Principles Of Clark Wealth Partners Our Clark Wealth Partners Ideas

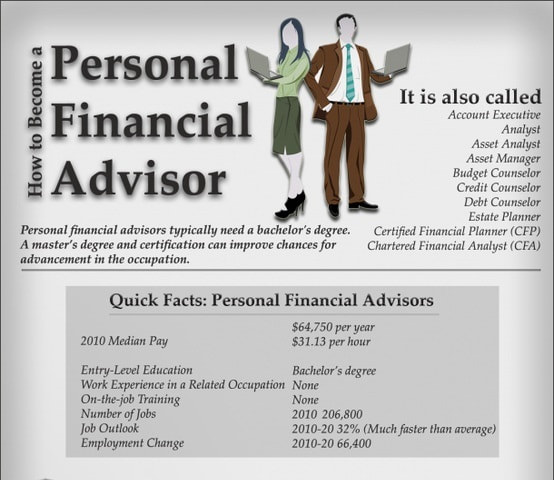

There's no single route to turning into one, with some individuals beginning in banking or insurance, while others start in accountancy. 1Most monetary organizers begin with a bachelor's degree in money, economics, audit, company, or a relevant subject. A four-year degree supplies a strong structure for careers in financial investments, budgeting, and customer service.Many hopeful organizers spend one to 3 years developing these functional skills. 3Although not legally needed, the CFP credential is extensively considered the market gold requirement. The exam is offered 3 times every year and covers areas such as tax obligation, retired life, and estate preparation. 4To make the CFP designation, you must complete either 6,000 hours of expert experience or 4,000 hours via the Instruction Pathway.

Usual examples include the FINRA Collection 7 and Series 65 tests for protections, or a state-issued insurance policy permit for selling life or medical insurance. While qualifications might not be lawfully required for all planning functions, employers and customers frequently watch them as a standard of professionalism and trust. We look at optional credentials in the next area.

About Clark Wealth Partners

A lot of economic coordinators have 1-3 years of experience and knowledge with monetary products, compliance criteria, and direct client communication. A strong educational history is essential, however experience demonstrates the capacity to use concept in real-world setups. Some programs incorporate both, permitting you to finish coursework while earning supervised hours through internships and practicums.

Early years can bring long hours, pressure to develop a customer base, and the demand to continuously verify your competence. Financial organizers enjoy the possibility to function carefully with customers, guide essential life decisions, and usually attain versatility in routines or self-employment.

Not known Facts About Clark Wealth Partners

To end up being a monetary organizer, you normally need a bachelor's level in money, economics, business, or a related subject and numerous years of pertinent experience. Licenses might be called for to sell safeties or insurance coverage, while qualifications like the CFP improve reputation and profession possibilities.

Optional accreditations, such as the CFP, generally need extra coursework and testing, which can prolong the timeline by a number of years. According to the Bureau of Labor Stats, individual financial consultants make a median annual annual income of $102,140, with top income earners making over $239,000.

Some Known Details About Clark Wealth Partners

will certainly retire over the following decade. To load their shoes, the nation will certainly need greater than 100,000 brand-new financial consultants to go into the sector. In their everyday work, financial consultants manage both technical you can look here and imaginative tasks. U.S. Information and Globe Record ranked the role amongst the top 20 Ideal Business Jobs.

Assisting individuals attain their monetary objectives is a monetary expert's primary function. However they are additionally a small company proprietor, and a section of their time is committed to handling their branch workplace. As the leader of their practice, Edward Jones economic advisors need the management skills to employ and take care of personnel, as well as the company acumen to develop and perform a business method.

The Best Guide To Clark Wealth Partners

Continuing education and learning is a required part of keeping a financial expert license - https://www.cybo.com/US-biz/clark-wealth-partners. Edward Jones monetary advisors are motivated to seek extra training to widen their understanding and skills. Commitment to education safeguarded Edward Jones the No. 17 spot on the 2024 Training APEX Awards list by Training magazine. It's additionally an excellent idea for financial advisors to attend market seminars.

Edward Jones economic experts appreciate the support and camaraderie of various other monetary advisors in their region. Our economic advisors are urged to supply and get support from their peers.

The Basic Principles Of Clark Wealth Partners

2024 Ton Of Money 100 Finest Companies to Benefit, released April 2024, study by Great Places to Work, information as of August 2023. Compensation gave for making use of, not getting, the ranking.

When you require assistance in your monetary life, there are several experts you may seek assistance from. Fiduciaries and monetary consultants are 2 of them (financial company st louis). A fiduciary is a professional who takes care of cash or residential property for various other events and has a legal responsibility to act only in their client's benefits

Financial consultants must arrange time weekly to satisfy brand-new individuals and capture up with the people in their round. The monetary services industry is greatly controlled, and laws transform usually. Several independent financial advisors spend one to two hours a day on compliance tasks. Edward Jones monetary experts are lucky the home workplace does the heavy lifting for them.

Some Known Incorrect Statements About Clark Wealth Partners

Edward Jones economic experts are encouraged to seek extra training to broaden their expertise and skills. It's additionally a good idea for economic experts to attend market seminars.

Edward Jones financial consultants enjoy the assistance and sociability of other financial experts in their region. Our monetary experts are motivated to provide and get support from their peers.

2024 Ton Of Money 100 Ideal Business to Work For, published April 2024, study by Great Places to Work, data as of August 2023. Compensation offered making use of, not acquiring, the rating.

How Clark Wealth Partners can Save You Time, Stress, and Money.

When you need assistance in your financial life, there are a number of professionals you may seek advice from. Fiduciaries and monetary advisors are 2 of them. A fiduciary is a specialist who manages money or residential or commercial property for various other celebrations and has a legal obligation to act only in their customer's finest passions.